VIRGINIA BEACH, Va. — From groceries to cars, Americans are paying some of the highest prices in decades due to high inflation rates.

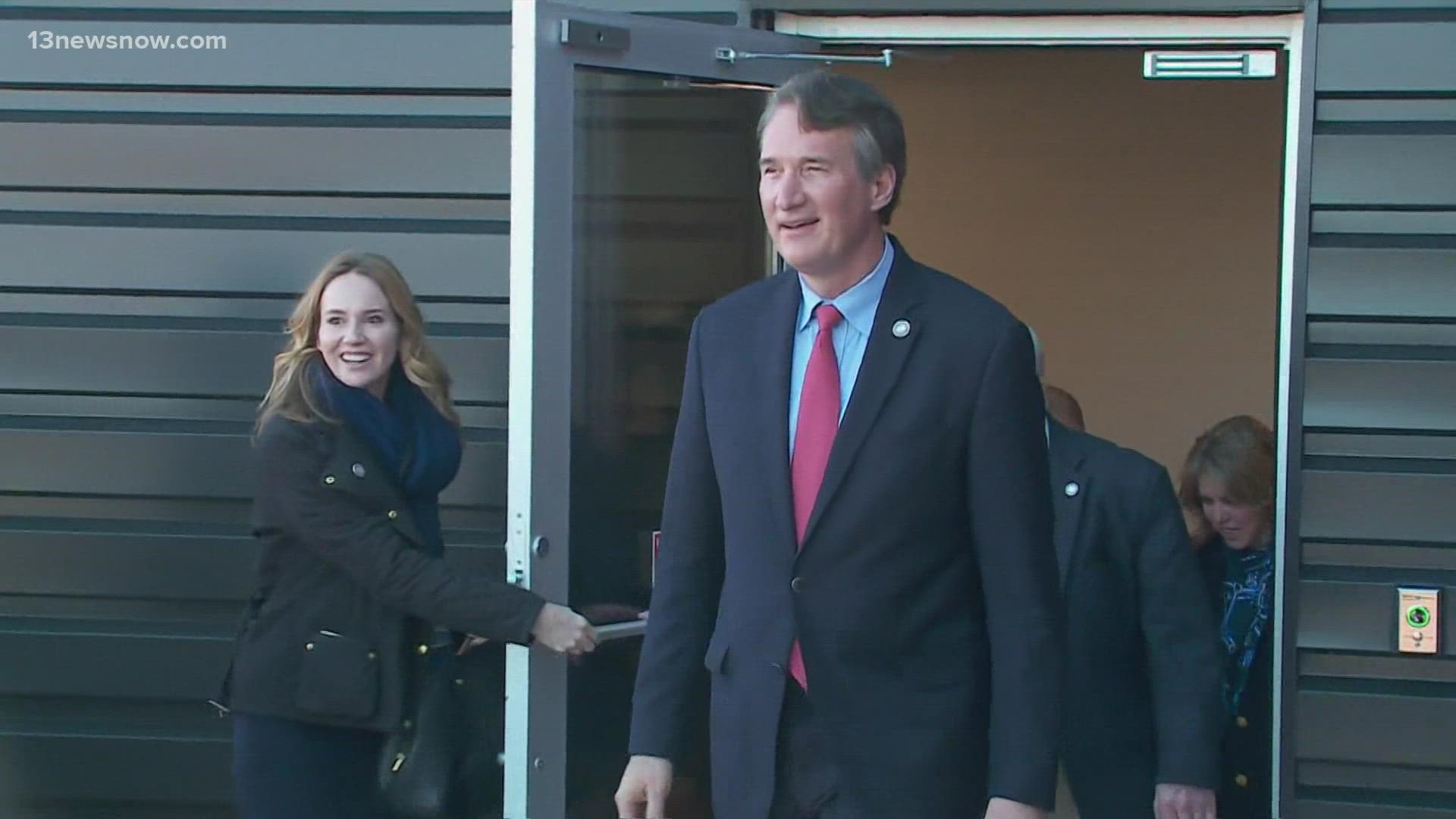

Gov. Glenn Youngkin pushed his plans for tax cuts while touring businesses in Virginia Beach Thursday.

Youngkin toured Anchor Allie's Bistro and Drone Up, a drone services company, along with Virginia's Secretary of Commerce and Trade Caren Merrick and Secretary of Veteran Affairs Craig Crenshaw.

Drone Up CEO Tom Walker said the company has grown exponentially since the pandemic began, including a partnership with Walmart to launch a drone delivery service.

According to Walker, the company once housed only a handful of employees in its offices on Newtown Road. Roughly 125 people work at that location and the company expects to reach 600 employees, overall, by the end of 2022.

Drone Up's workforce is largely comprised of veterans, and Youngkin told reporters it is the type of company he had in mind when he suggested excluding $40,000 of veterans' retirement benefits from taxes, as part of his overall plan.

"What we're not going to do is continue to pile on cost of living taxes on top of cost of living taxes," Youngkin said.

The Republican governor has been vocal about his desire to lower taxes for Virginians, dating back to his campaign.

He also proposes a one-year suspension of the most recent gas tax increase of 5 cents per gallon, which went into effect in July.

Right now, gas prices are higher than when the increase went into effect, as Americans face rising costs due to inflation. According to AAA, the current cost of gas in Virginia is $3.33 -- a dollar more than this time in 2021.

Youngkin also wants to eliminate the grocery tax.

RELATED: Gov. Youngkin wants to eliminate Virginia's food tax; he'll need the General Assembly to do it

However, critics of his plan question how the state will make up the money those taxes generate, including the roughly $600 million from the grocery tax last year.

"There is so much money in the system," Youngkin said. "So much money in the system."

Youngkin said he believes the Commonwealth can afford to cut the tax and would still be able to provide services, especially given the state's historic $2.6 billion surplus in the fiscal year 2021.

"We can do both and it can aggregate up to $1,500 for the typical Virginia family," he said.

But will the General Assembly go along with the governor's plan?

Virginia lawmakers would need to give their stamp of approval on any changes in taxes.

There is Senate Bill 609, sponsored by Sen. Bill DeSteph, that would cut taxes on "food purchased for human consumption and essential personal hygiene products." It's been referred to a Senate committee.