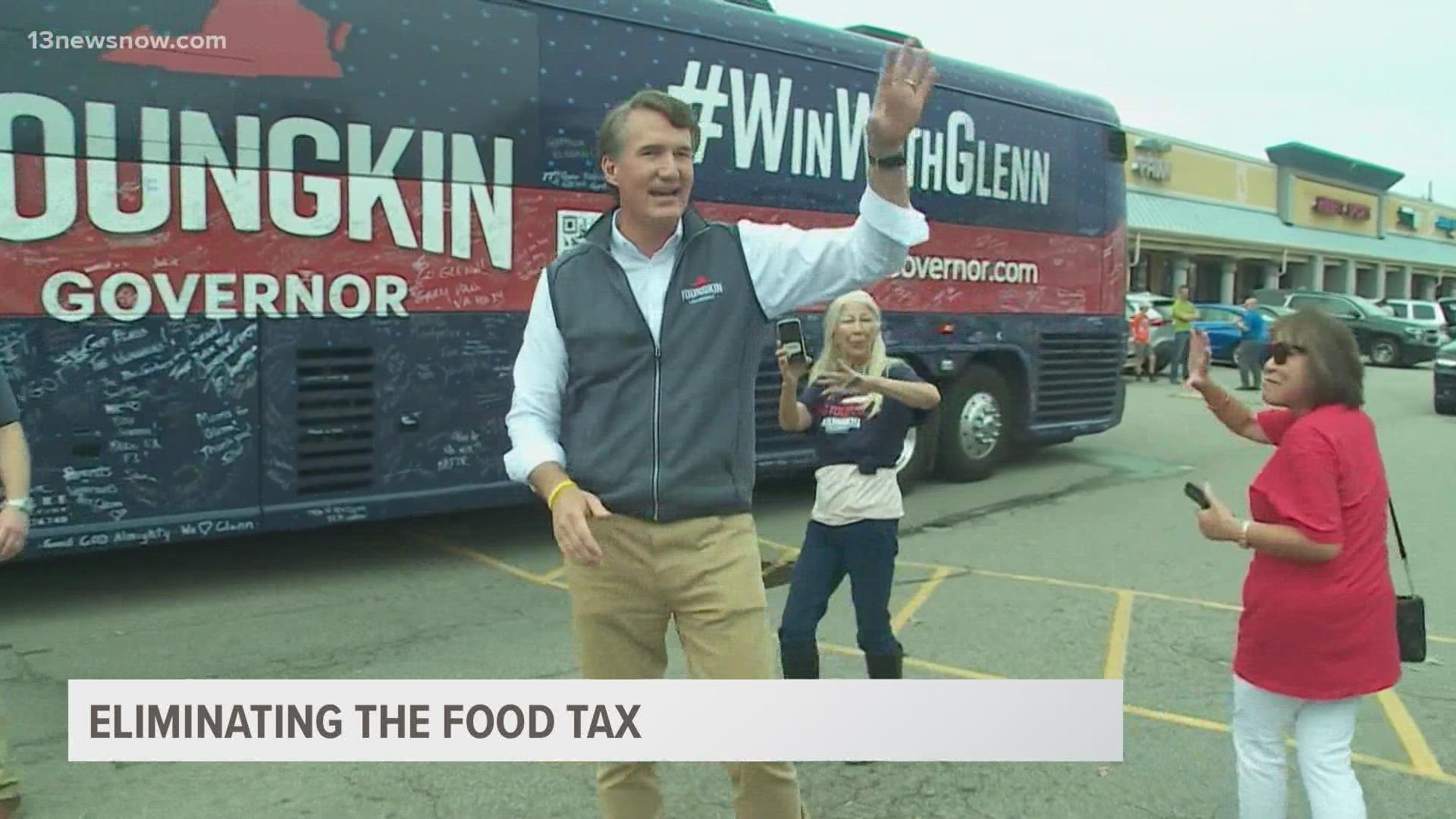

RICHMOND, Va. — Virginia is one of 13 states that imposes a sales tax on groceries. On the campaign trail, Governor-to-be Glenn Youngkin pledged to get rid of it.

But he can't do it alone by executive order. He needs the General Assembly.

The sovereign power of taxation is a concept that dates back to 1765 and Patrick Henry. His Stamp Act Resolutions in the Virginia House of Burgesses established that "The General Assembly of this Colony have the only and exclusive Right and Power to lay Taxes and Impositions upon the inhabitants of this Colony."

Virginia Wesleyan University Associate Professor of Political Science Dr. Leslie Caughell said it's a fundamental example of the principle of the separation of powers among the executive, legislative and judicial branches of government.

"The logic of the United States government -- both at the state and the federal level -- is to divide power as much as possible to keep an individual or a group of individuals from being able to exercise a tyrannic level of power," she said.

Fast forward back to 2022, and there is Senate Bill 609 from Senator Bill DeSteph (R-Virginia Beach). It states that "tax...shall not be levied upon food purchased for human consumption and essential personal hygiene products."

But Virginia is required under its Constitution to maintain a balanced budget, so the loss of that $600 million in revenue must be made up.

Under current law, the revenues from the food tax are split between the state and localities. It's spent on K-12 education, highways, rail, harbors, and airports.

DeSteph said the money can easily be found elsewhere.

"We have a good revenue stream," he said. "We have an excess of dollars at the state level. One of the things to do is to help those who need it the most. Those who need it the most are in the grocery stores. So that's why we're carrying this bill."

At the end of the 2020–21 fiscal year, Virginia had a $2.6 billion surplus, the largest ever. DeSteph's bill has been referred to the Senate Committee on Finance and Appropriations.

There is no date yet for when the measure will get a hearing.