WASHINGTON — The IRS announced Wednesday that those who receive Social Security benefits and are not typically required to file tax returns will also not need to file one to get their stimulus check from the record $2.2 trillion coronavirus aid package. That's a reversal from a previously announced policy.

Instead of having to file a "simple tax return," payments will be automatically deposited into their bank accounts, according to Treasury Secretary Steven Mnuchin.

“We want to ensure that our senior citizens, individuals with disabilities, and low-income Americans receive Economic Impact Payments quickly and without undue burden,” Mnuchin said in a statement. “Social Security recipients who are not typically required to file a tax return need to take no action, and will receive their payment directly to their bank account.”

The IRS will use the information on the Form SSA-1099 and Form RRB-1099 to generate $1,200 payments to Social Security recipients who did not file tax returns in 2018 or 2019. They will receive these payments as a direct deposit or by paper check.

Before the announcement, the IRS had posted guidance on its website Monday that said low-income taxpayers, senior citizens, Social Security recipients, some veterans and individuals with disabilities would need to file a simple tax return for the stimulus money.

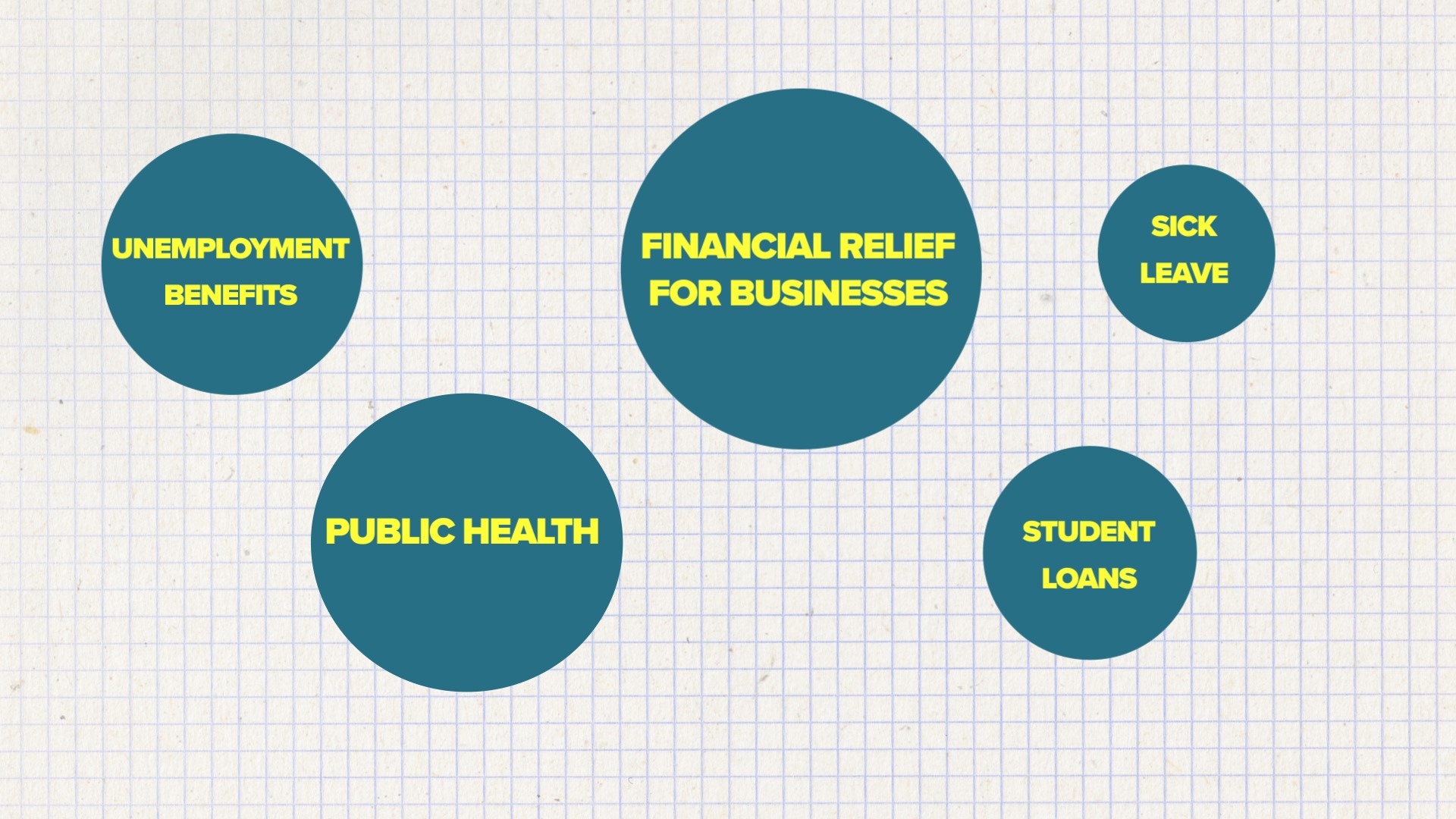

The measure, the largest economic relief bill in U.S. history, was signed into law last week by President Trump. The $2.2 trillion of aid is for individuals, workers, businesses and the health care system impacted by the COVID-19 pandemic.

The package provides one-time direct payments of $1,200 per individual adult and $2,400 for married couples, plus an additional $500 for each eligible child. The full amount is available for individuals making less than $75,000 and couples making less than $150,000 annually. The amount a person receives phases out if they earn more, ending for those making over $99,000 individually or $198,000 as a couple.

The IRS said Monday the payments will be distributed in the next three weeks.