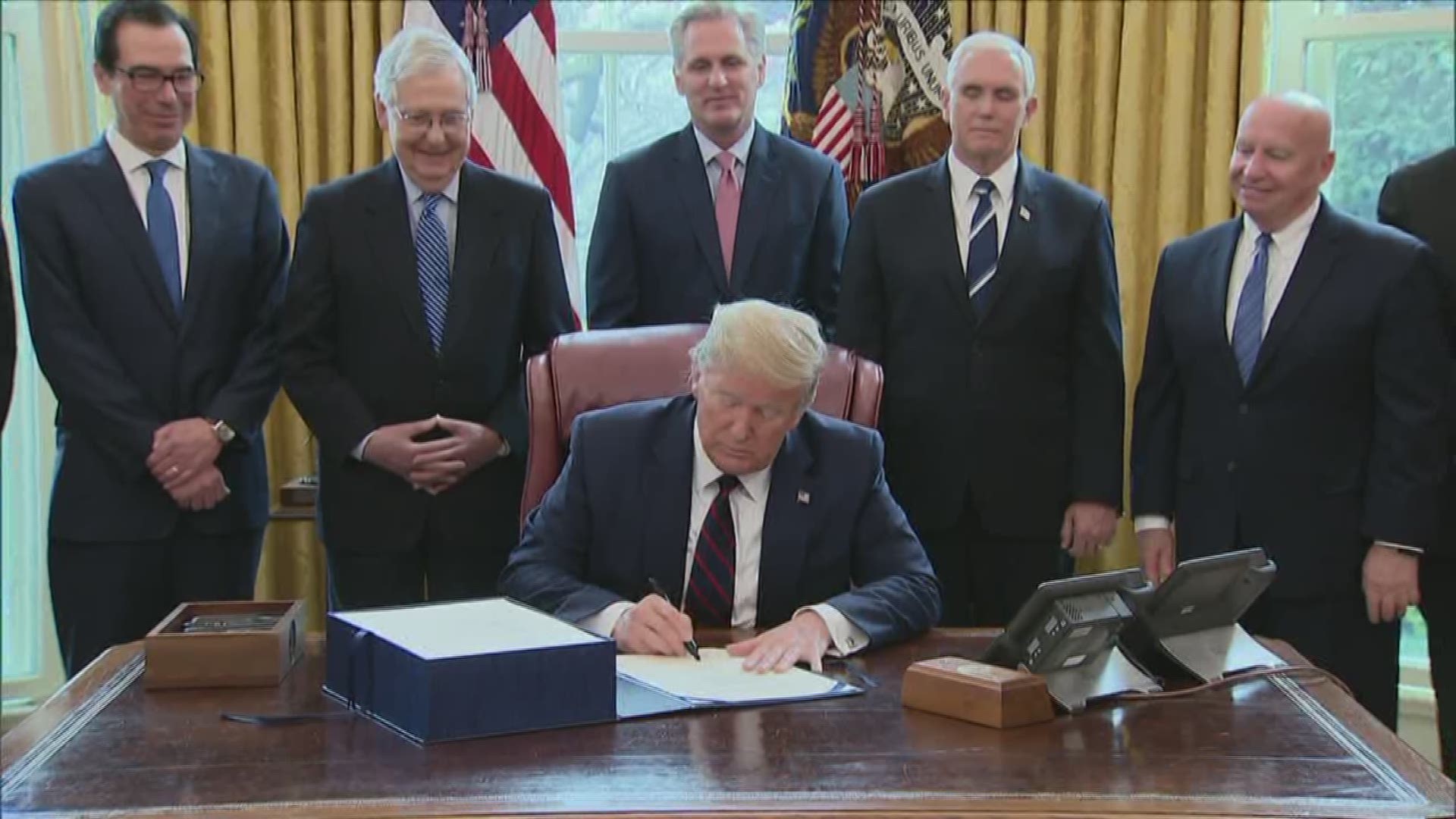

WASHINGTON — The largest economic relief bill in U.S. history was signed into law last month, paving the way for $2.2 trillion in aid for individuals, businesses, workers and health care systems engulfed by the coronavirus pandemic.

The package provides one-time direct payments to Americans of $1,200 per individual adult and $2,400 for married couples, plus an additional $500 for each eligible child.

The full amount will be available for individuals making less than $75,000 and couples making less than $150,000 annually. The amount a person receives will phase out if they earn more, ending for those earning more than $99,000 annually.

Use the calculator below to see how much you will likely receive and scroll down for the answers to some of the big questions people have been asking about the stimulus checks.

Will you get a stimulus check if you receive Social Security?

Yes, the stimulus package includes language that allows people who receive Social Security – many of whom are retired and do not file taxes – to receive money.

Treasury Secretary Steven Mnuchin announced April 1 that Social Security beneficiaries who are not typically required to file tax returns will not need to file an abbreviated tax return to receive an Economic Impact Payment. Instead, payments will be automatically deposited into their bank accounts.

“Social Security recipients who are not typically required to file a tax return do not to need take an action, and will receive their payment directly to their bank account,” said Secretary Steven T. Mnuchin.

Mnuchin's comments came after the IRS had posted guidance earlier in the week that said Social Security recipients would still need to file.

According to Mnuchin's statement, the IRS will use the information on the Form SSA-1099 and Form RRB-1099 to generate $1,200 Economic Impact Payments to Social Security recipients who did not file tax returns in 2018 or 2019. Recipients will receive these payments as a direct deposit or by paper check, just as they would normally receive their benefits.

Will you get a stimulus check if you normally aren't required to file a tax return?

Yes. The IRS has recently reversed course after saying people who typically do not file a tax return would need to file a simple tax return to receive an economic impact payment.

On April 1, Treasury said that it will use info on record for senior citizens, Social Security recipients and railroad retirees who are not otherwise required to file a tax return.

According to the agency's website, "The IRS will use the information on the Form SSA-1099 or Form RRB-1099 to generate Economic Impact Payments to recipients of benefits reflected in the Form SSA-1099 or Form RRB-1099 who are not required to file a tax return and did not file a return for 2018 or 2019."

Since the IRS would not have information regarding any dependents for these people, each person would receive $1,200 per person, without the additional amount for any dependents at this time.

Will you get a check if you didn't file tax returns in 2019?

If you haven't yet filed your tax returns for 2019, the IRS will use the information from your 2018 returns to determine your eligibility for a stimulus check.

I need to file a return still, how long are the payments available?

The stimulus payments will be available throughout the rest of 2020, according to the IRS, so you still have time to file a return and get a payment.

When will stimulus checks go out?

The IRS said Saturday, April 11, that the first economic support payments have been deposited in taxpayers’ bank accounts.

In its tweeted announcement Saturday night, the IRS didn’t say how many taxpayers have received the payments or how much money has been disbursed so far.

“We know many people are anxious to get their payments; we’ll continue issuing them as fast as we can,” the tweet says.

Democratic aides in the Senate told The New York Times that those with direct-deposit info on-file with the IRS should see payments within a few weeks of the bill becoming law. However, if the IRS doesn't have that info, people may need to wait a lot longer to get a check. Aides told the Times it could be up to four months for a physical check to arrive.

The Tax Policy Center noted that in 2008 there was a gap of about three months between passage of the stimulus legislation and the start-up of payments. Additionally, the IRS had worked for three months before enactment of advance payments of tax rate reductions in 2001 and child tax credits in 2003.

What can I do if the IRS doesn't have my bank information?

The IRS announced that the Treasury Department plans to "develop a web-based portal for individuals to provide their banking information to the IRS online, so that individuals can receive payments immediately as opposed to checks in the mail."