INDIANAPOLIS — Claims now circulating on social media state President Biden and his administration want more access to bank account information for millions of Americans.

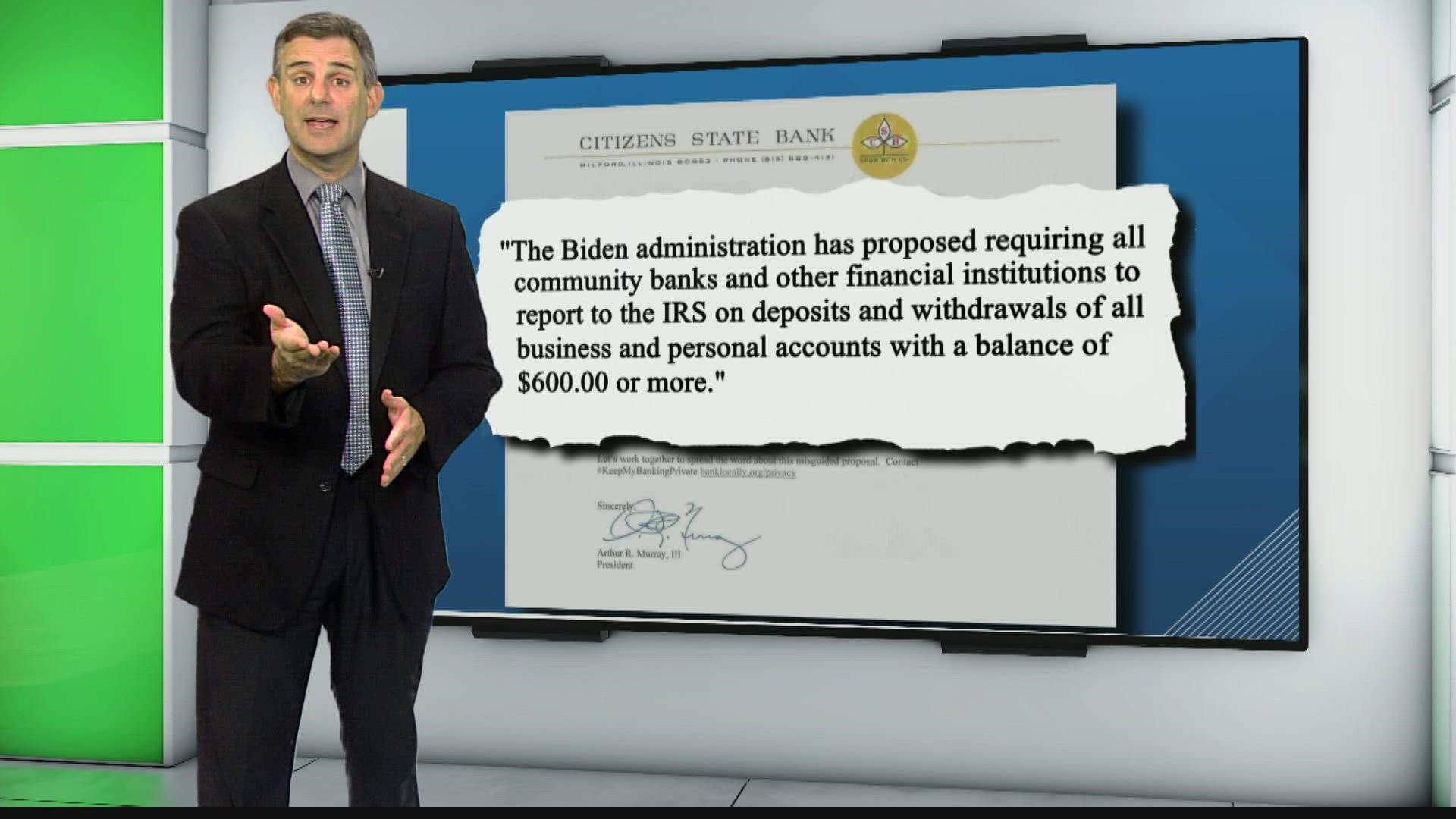

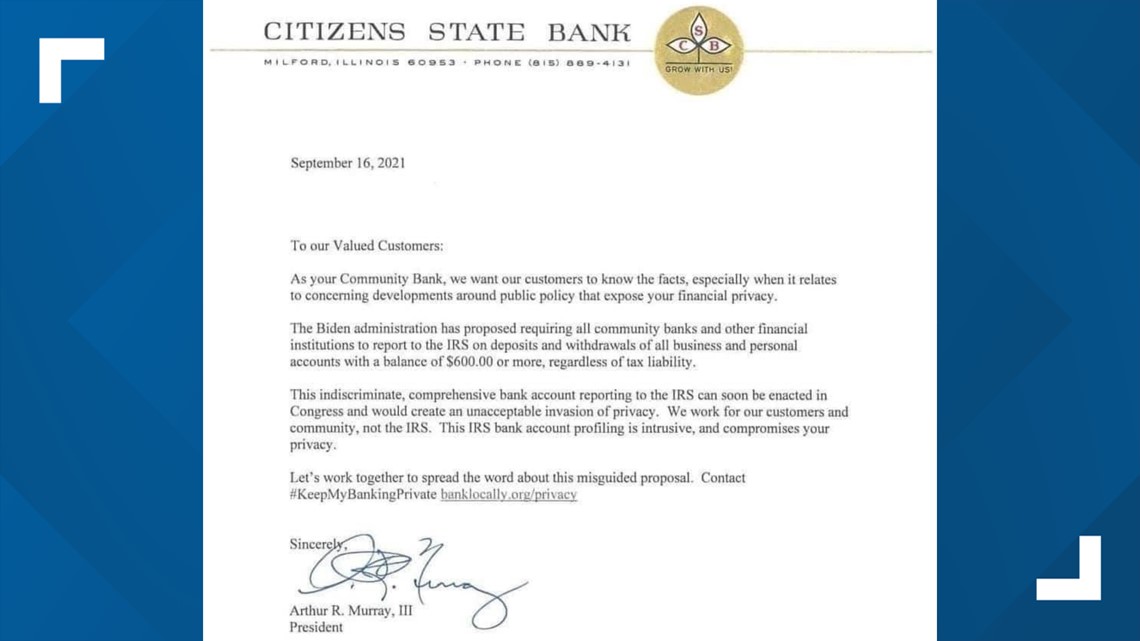

A popular post on Facebook, which appears to be from the president of a small bank in Illinois, says: "The Biden administration has proposed requiring all community banks and other financial institutions to report to the IRS on deposits and withdrawals of all business and personal accounts with a balance of $600.00 or more." The bank executive goes on to warn customers that the plan is "intrusive and compromises your privacy.”

Other claims, like this one on TikTok, say the plan goes even further by requiring banks to monitor bank accounts and to “report ALL your banking info the IRS.”

Dozens of 13News viewers have contacted VERIFY to ask if the warnings on social media are accurate and if the Biden administration has proposed a plan that would require banks to divulge more information about millions of checking and savings accounts.

THE QUESTION

Is it true that a proposal from President Biden would give the IRS more access to information about bank accounts with assets totaling at least $600?

THE SOURCES

- Arthur Murray, president of Citizens State Bank

- U.S. Treasury Secretary Janet Yellen

- Senate testimony from IRS Commissioner Charles Rettig

- Dax Denton, government relations senior vice president at the Indiana Bankers Association

THE ANSWER

Yes, the Biden administration plan would require banks to tell the IRS the total annual amount of money deposited into and withdrawn from your bank account if those funds total at least $600. But claims that the proposal would require financial institutions to constantly monitor customer accounts and report ALL bank account information to the IRS are overstated and inaccurate.

WHAT WE FOUND

Earlier this year, President Biden announced his intentions to seek tax reforms. We got a closer look at those reforms when IRS Commissioner Charles Rettig testified before the Senate Finance Committee in June.

His testimony includes a proposed requirement that financial institutions report data to the IRS on all bank accounts that have total deposits and withdrawals of at least $600. According to Rettig’s testimony submitted to the committee:

Financial institutions would report data on financial accounts in an information return. The annual return will report gross inflows and outflows with a breakdown for physical cash, transactions with a foreign account, and transfers to and from another account with the same owner. This requirement would apply to all business and personal accounts from financial institutions, including bank, loan, and investment accounts, with the exception of accounts below a low de minimis gross flow threshold of $600 or fair market value of $600.

The plan is intended to help the IRS crack down on tax evasion, resulting in billions of dollars in revenue for the U.S. Treasury that would otherwise remain uncollected.

Treasury Secretary Janet Yellen sent a letter to the chairman of the House Ways and Means Committee to voice her enthusiastic support of the proposal.

But banks say it's a terrible idea.

Last week, dozens of organizations representing the banking industry and other business groups wrote Congressional leaders urging them to oppose the proposed tax reporting requirements for banks.

“This proposal would create significant operational and reputational challenges for financial institutions, increase tax preparation costs for individuals and small businesses, and create serious financial privacy concerns. We urge members to oppose any efforts to advance this ill-advised new reporting regime,” the letter said.

The Indiana Bankers Association says the plan would mean turning over a mountain of data to the IRS, and the lobbying organization worries about customer privacy and security.

“The IRS is constantly under attack by cyberattacks, and we've seen different data breaches over the years involving the IRS. So there's concern about how they're going to store and manage all this data,” explained Dax Denton, a government relations advisor at the Indiana Bankers Association. “We’re talking about a lot of customers and a lot of data, and candidly I don’t believe the IRS has the capability currently to manage and sift through all this data to identify noncompliance.”

That’s why Citizens State Bank president Arthur “Rob” Murray sent a letter to his customers in the town of Milford, Illinois. (The letter currently also appears as a prominent popup on the bank’s internet homepage.) Murray told VERIFY he wrote the letter after learning of the Biden plan from a banking association, and he is surprised to see his words go viral on Facebook.

“I’m amazed at the number of phone calls I’m getting about it,” he said. “To me, as a small town banker, it’s quite an invasion of privacy and I felt I needed to alert our customers. Just wanting to do my part to let people know what’s happening in D.C.”

Claims that the plan would allow the government to monitor your bank accounts and give access to ALL of your banking information are not accurate. The actual proposal revealed by Rettig would require banks to report only total annual deposits and withdrawals, not individual transactions.

If approved by Congress, the plan would take effect in 2023. But right now, it’s only a proposal that must get through the reconciliation process on Capitol Hill. The plan could change or be dropped all together as Congress debates the proposal over the next few months.