RICHMOND, Va. — On Tuesday, Virginia Gov. Glenn Youngkin signed a bill that offers tax relief for surviving spouses of military members who died in the line of duty.

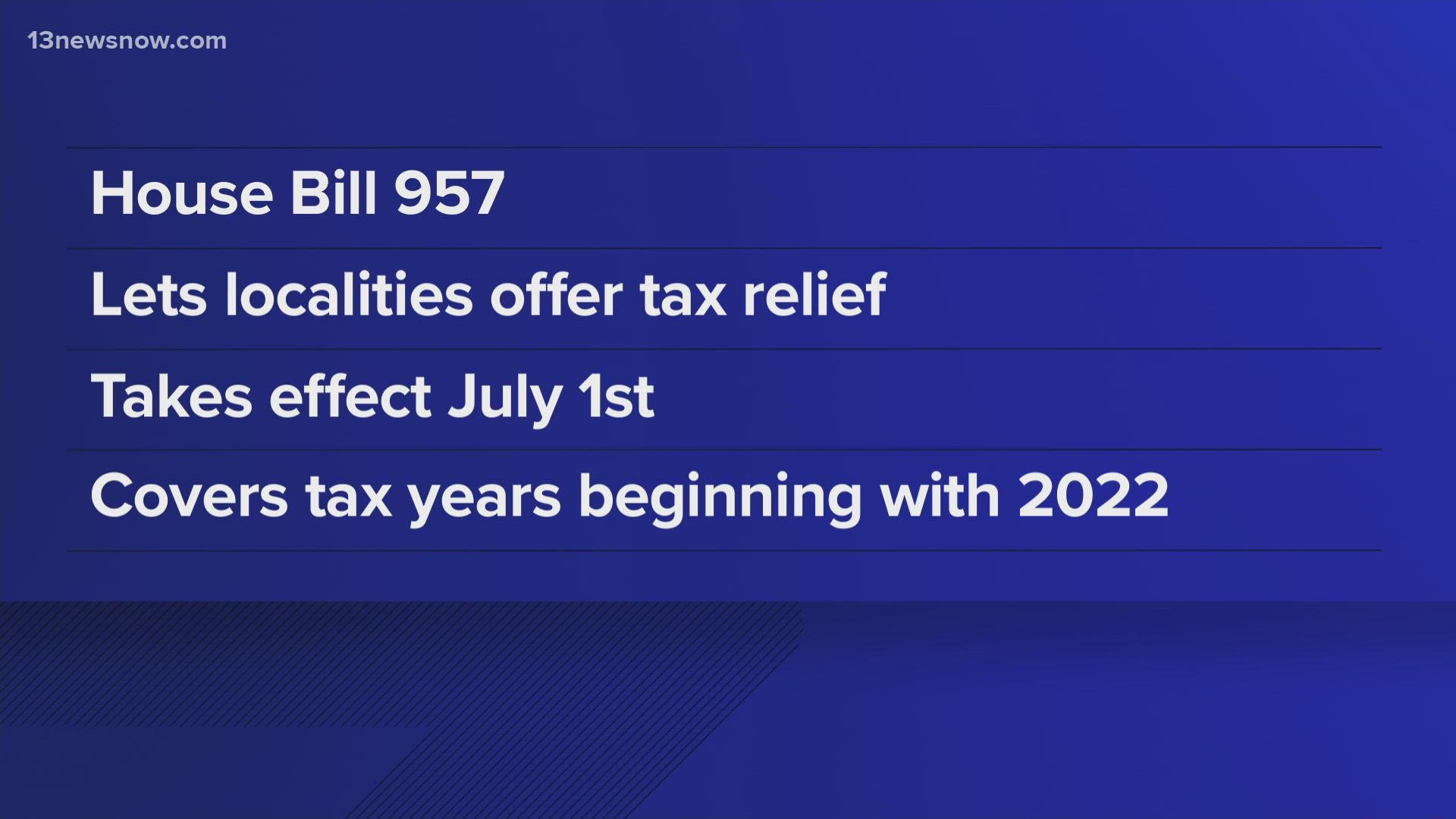

House Bill 957 gives local governments the option to declare real property — land and anything attached to that land — owned by a surviving spouse of a military member who died in the line of duty as a separate class of property for local taxation purposes.

That means local governments can set a tax rate on those properties different from other real properties. The bill requires the tax rate must be more than 0% and less than the rate on the general class of real property.

It was passed unanimously by the Virginia House of Delegates and Senate.

“By taking care of our Gold Star Families, we honor the legacy of our service men and women, who gave their lives to protect our freedom,” Gov. Youngkin said. “This legislation enables local governments to give something back to families who have sacrificed so much on behalf of this country.”

The law would become effective July 1, 2022, for the taxable years beginning on or after Jan. 1, 2022.

To claim the property classification under the law, the spouse must not have remarried and the service member's death must be verified by the Defense Department and confirmed that the death was not the result of criminal conduct.