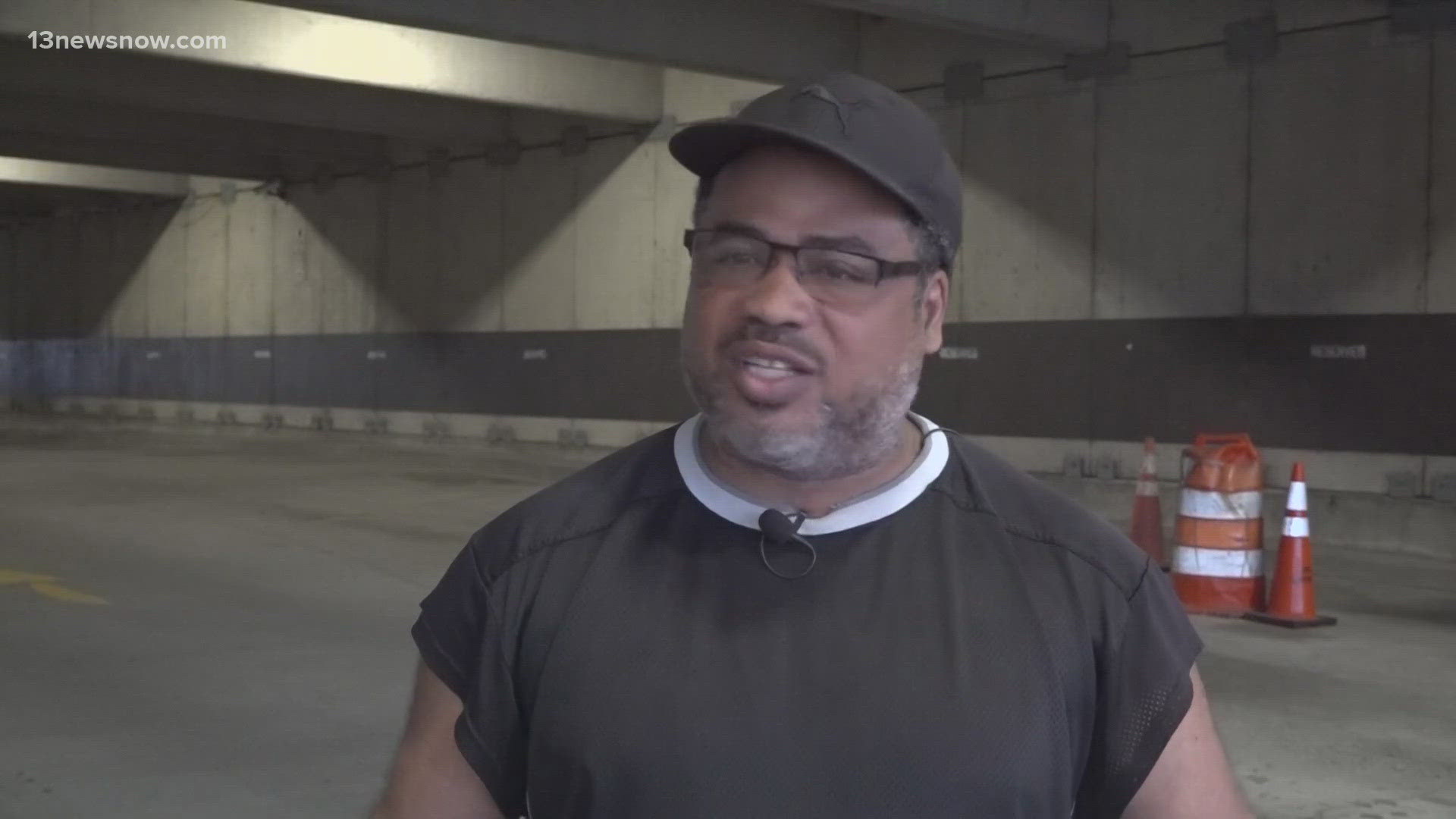

HAMPTON, Va. — Lamar Parker says his identity was stolen in 2020, and now the IRS is threatening to garnish his and his ex-wife’s wages.

“It’s countdown for me. They’re [IRS] giving me and my ex-wife 30 days to come up with over $5,000 for something that we did not do. We’re both victims here,” the Hampton man told 13News Now.

Parker said someone in California, stole his identity in 2020 and used it to file for unemployment benefits. In 2021, he said he learned his identity was stolen.

“Someone stole my identity and applied for and received over $2,700 of unemployment benefits from Sacramento, California,” said Parker. “I’ve worked two jobs. I’ve never had to file for unemployment benefits.”

Parker said he contacted the IRS office in Sacramento and the IRS headquarters in Washington, DC, but he has yet to receive an answer.

According to the IRS, in recent years, states have experienced a surge in fraudulent unemployment claims since the 2020 pandemic.

“Lots of people were unemployed, so I’ve seen this quite a few times,” says Quennie Banks, a Norfolk-based tax expert and owner of TaxGuru Financial & Public Services.

However, there is a potential solution.

The IRS recommends that you contact a tax professional to help walk you through the process. Also, always respond to letters from the IRS, contact the taxpayer advocate service offered by the IRS, and, lastly, set up a payment plan while the IRS investigates your case of identity theft.

“Interest accrues daily, and you don’t want to get stuck with a big bill, so in the meantime, please make [a] payment plan, and the IRS will send you a check in the mail for the amount that you did pay [once the investigation is complete],” said Banks.

According to the IRS, there are some signs that you could be a victim of unemployment identity theft.

First, if you have not recently filed for unemployment benefits but are receiving mail from a government agency about an unemployment claim or payment, this is a sign of unemployment identity theft. Another sign is receiving an IRS Form 1099-G showing unemployment benefits you did not expect to receive.

If you want to protect your identity, Banks suggests people apply for an Identity Protection PIN or an IP PIN. This prevents someone else from filing a tax return using your social security number.