CHESAPEAKE, Va. — The economy is always the most defining issue in a presidential election

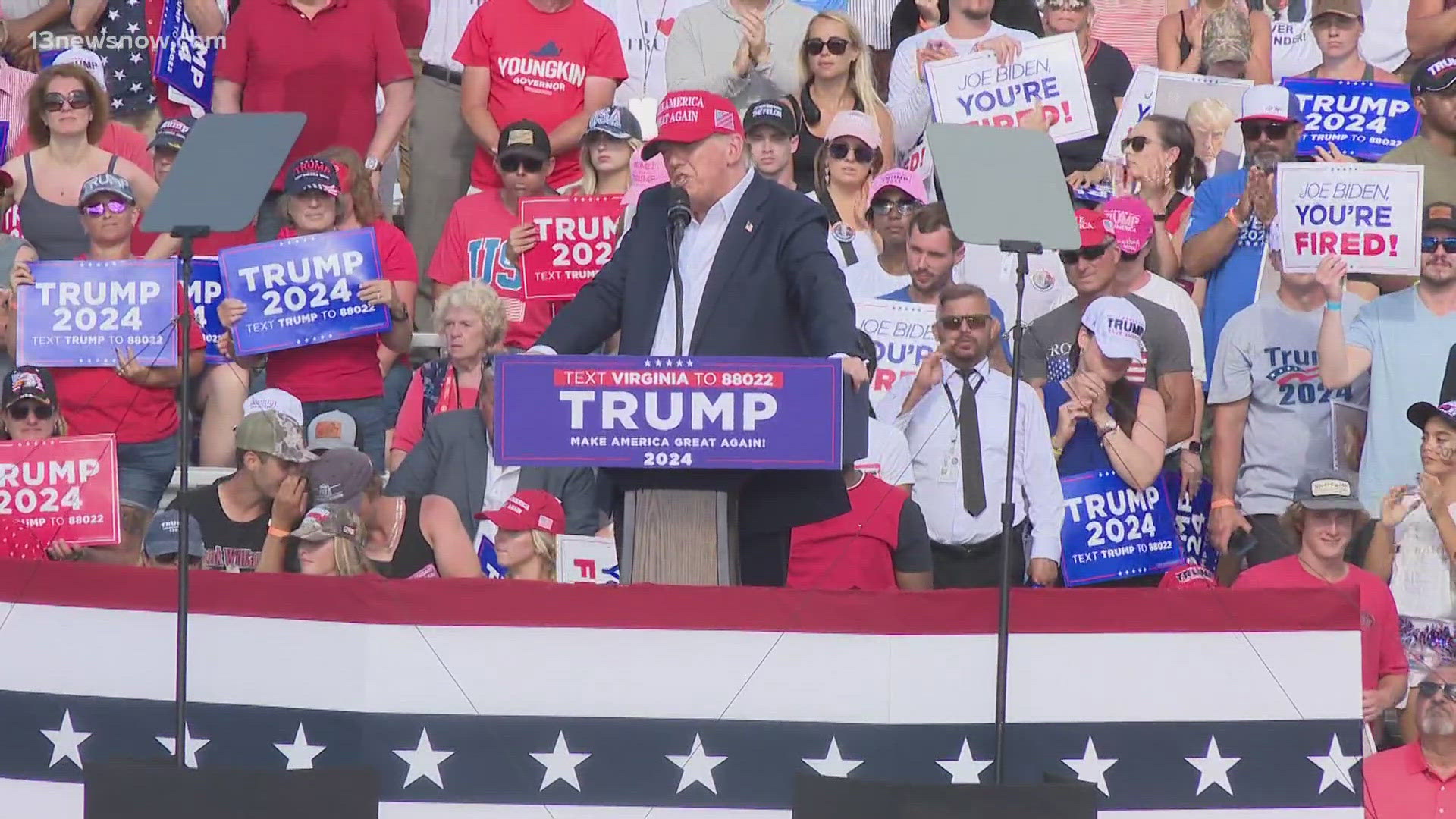

During the Trump rally in Chesapeake Friday, there was big talk about the economy, joining accusations on which candidate is best.

"Our economy will be roaring back," belted former President Donald Trump to the cheering crowd at Greenbrier Historic Farms.

In a Gallup survey last month, about seven in 10 Americans believe the economy is “getting worse.” Only 26 percent say it is getting better.

During the rally, Governor Glenn Youngkin took the stage and advantage of that perception. "The Trump economy had high growth and low inflation and the Biden economy has low growth and high inflation."

That is not entirely true, according to economists. Inflation under the Trump administration was low. But that was before the pandemic ushered in labor shortages and supply chain issues. Job growth plummeted once the pandemic shutdowns began in 2020. The Biden administration has enjoyed strong growth in the job market creating about 15 million jobs.

On Monday, the Bureau of Labor Statistics announced job openings unexpectedly grew in May to 8.1 million.

But many Americans are still grappling with the increased cost of living. White House economic advisor, Jared Bernstein is quick to note that increased spending and recent travel records are signs of a growing economy, along with dropping prices. "Grocery costs have been flat for a bit. We've had the gas prices down from a year ago and so we're moving in the right direction. We have to build on that progress," Bernstein said.

During the rally, Trump promised he would deliver what he called a 'Trump middle-class tax cut.' "We will have a brand new Trump economic boom. We're going to cut taxes."

The Biden administration is also dealing with high interest rates due to inflation. The 3.3 percent inflation rate is still below the Federal Reserve's target rate of 2 percent. Though inflation is cooling, Federal Reserve Chair Jerome Powell said Tuesday it's still not time to cut rates.

Bernstein says the President will focus on providing relief for potential homebuyers worried about the interest rates that includes a plan to build two million affordable homes.

"This president has robust big plans to provide people with the resources they need to buy that starter house to help offset these high interest rates, but we need congress to work with us."