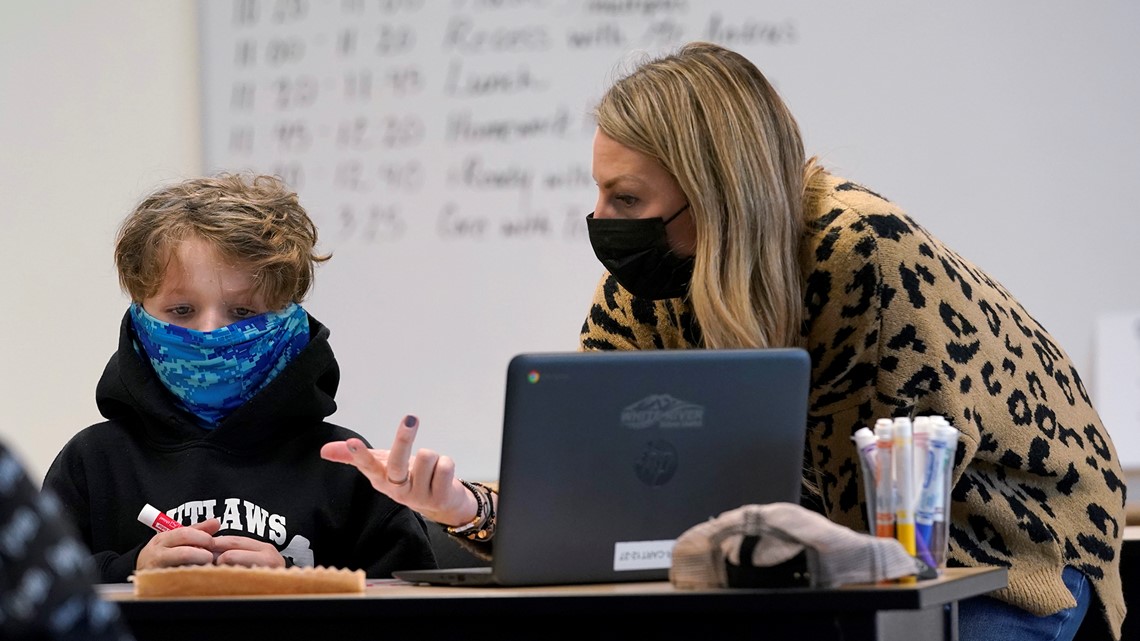

Educators who have purchased protective items for COVID-19 and have not been reimbursed can write them off on their taxes, the Internal Revenue Service announced Thursday. Any expenses for protective items purchased after March 12, 2020 can be included with a limit of up to $250 per person.

"Eligible educators include any individual who is a kindergarten through grade 12 teacher, instructor, counselor, principal, or aide in a school for at least 900 hours during a school year," the IRS said. The statement doesn't make it clear how this will affect many teachers who were forced to work remotely from home due to state and local coronavirus guidelines.

The following is the list of eligible items from the IRS:

- face masks

- disinfectant for use against COVID-19

- hand soap

- hand sanitizer

- disposable gloves

- tape, paint or chalk to guide social distancing

- physical barriers (for example, clear plexiglass)

- air purifiers

- other items recommended by the Centers for Disease Control and Prevention (CDC) to be used for the prevention of the spread of COVID-19

The $250 limit goes up to $500 if filing taxes jointly, but with no more than $250 per individual.

More information is available on the IRS website.