NORFOLK, Va. — Restaurant Revitalization Funds dried up in a matter of weeks over the summer. Hampton Roads business owners and leaders are still pushing legislators to get that pot filled back up.

A Small Business Administration release reports they received more than 250,000 applications and only had enough money to fund less than half of those.

“This is my baby. I built it and I spent my first seven to eight years every day from open to close,” said D’Egg owner Phillip Decker.

As the pandemic rages on, Decker said his Downtown and Hampton Boulevard locations are still standing, but like other restaurants, problems are stacking up.

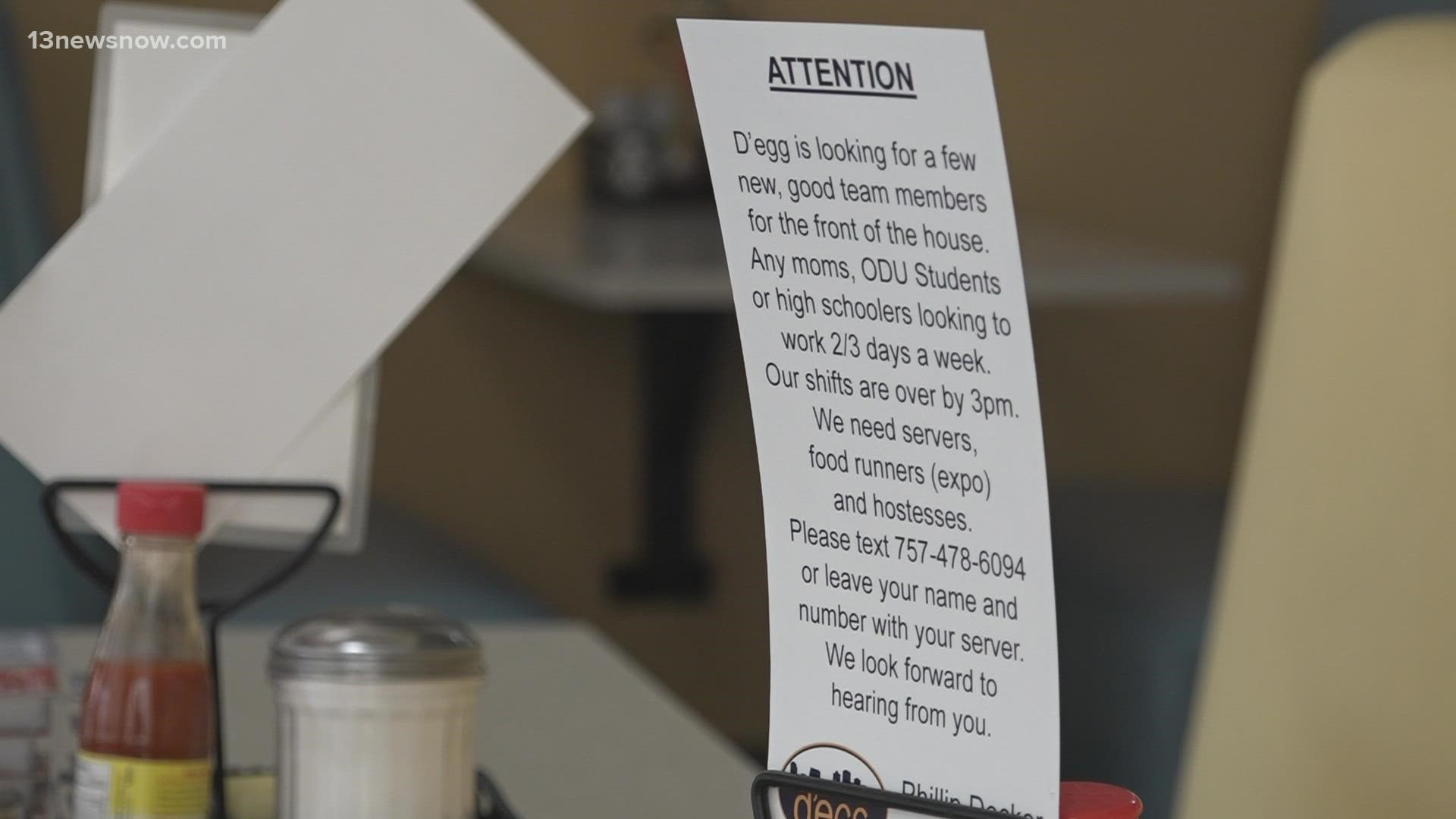

“Both locations are shuttered for a couple of days just to give the staff a break,” Decker said. “There is not that much front-of-the-house staffing in any restaurants in Hampton Roads.”

Decker said he’s grateful he got some PPP loans. But when he applied for the Restaurant Revitalization Fund in May the application sat in limbo.

“Like a lot of other people, we got shut out,” Decker said.

The program closed on May 24, three weeks after calling for applications. According to a Small Business Administration release they received 278,000 applications, more than $72 billion in requested funds. But only had $28 billion to give to 101,000 applicants.

“Some people got in, some people got in and didn’t get the money,” said Hampton Roads Chamber Small Business Vice President Jim Carroll.

At first, the SBA prioritized women, veteran and minority-owned businesses, but Carroll said that didn’t last.

“It lasted about a few weeks and then there were several lawsuits filed in Tennessee and Texas that said the way they structured it was viewed as discriminatory,” Decker said. “The SBA had to go back and change the way they did business and opened it up for everyone.”

Still, that didn’t help Decker’s downtown spot. In August, U.S. Senators Mark Warner and Tim Kaine sent a letter to Senate Leadership pushing to refill the RRF pot.

“I have been in contact with him and he is diligently trying to push it through,” Decker said.

Decker is crossing his fingers for more relief.

“The RRF would certainly help with the nervousness of not knowing what’s coming in the future,” Decker said.

Carroll said businesses can still apply for Economic Injury Disaster loans. He said owners don’t have to make payments for the first two years.

Also an important note: time is running out for the Economic Injury Disaster Loan. Carroll said the application window closes at the end of this year.