As millions of Americans cast their ballots on Election Day, November 5, they're not just choosing political leaders – they may also be feeling pressure to rethink their financial strategies. Election results can bring emotional responses, especially when it comes to personal finances. But, reacting impulsively to political outcomes could jeopardize a solid financial plan.

Old Dominion University Economics professor, Dr. Bob McNab shed light on how savings and investments could potentially be impacted by the election.

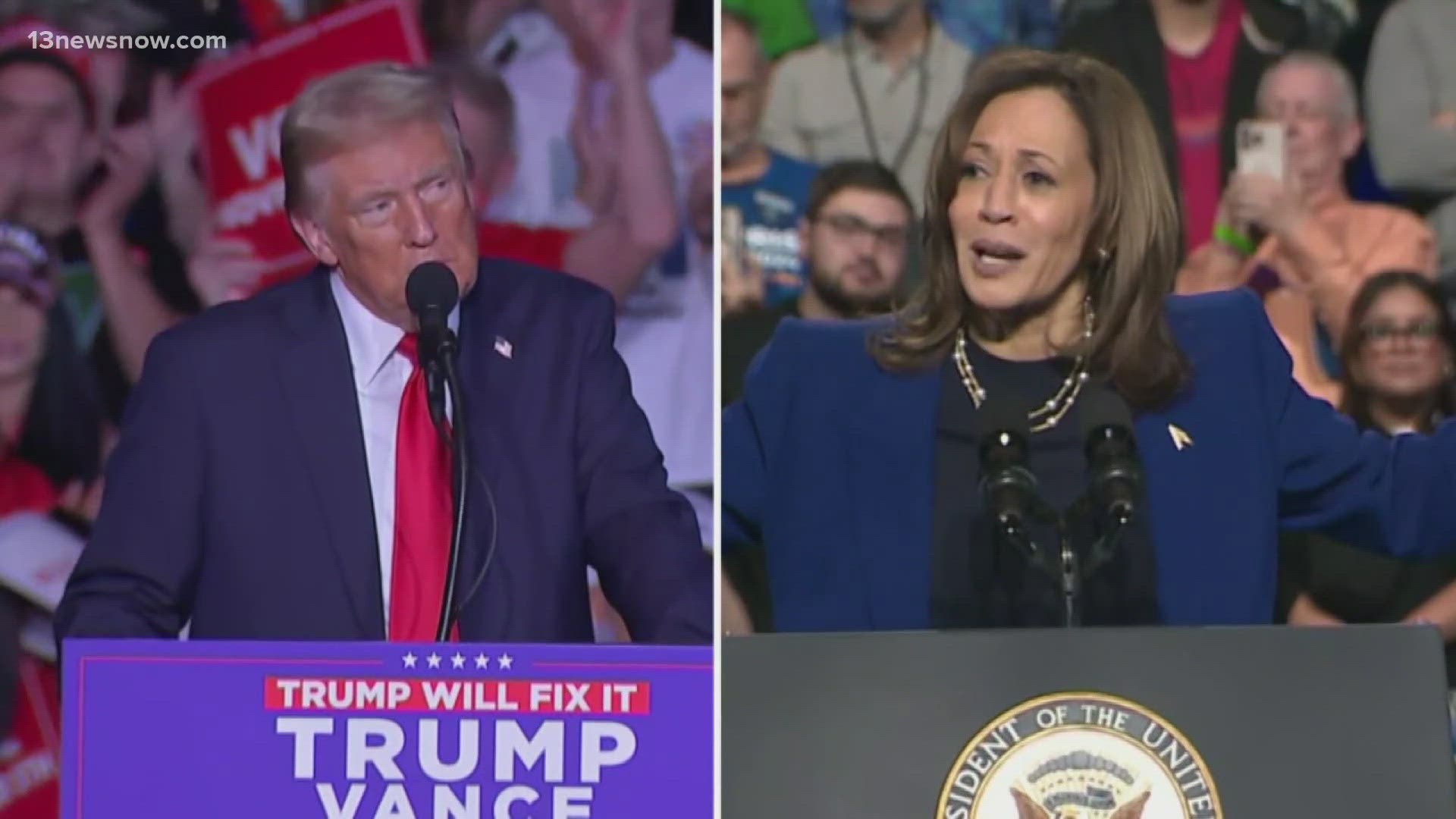

"This presidential election, you have two candidates with very different policy proposals that are going to impact the stock market and potentially real estate prices," said McNab. "If there’s... broad-based tariffs, for example, levied on goods imported not only from China but from Europe, then you’re going to see higher rates of inflation and interest rates, which would negatively impact stock prices.… If there are large-scale changes to immigration policy, you can see workforce shortages develop and, again, sparking inflation. And then, the Federal Reserve would see itself in a hard place between higher inflation and lower growth. And, of course, we’ve seen policy proposals to reduce or eliminate taxes on tips and increase credits for homeowners, which would spark more deficit spending– which is not good for the long-term physical health of the U.S. government."

However, McNab advised people to "take a deep breath" before making major financial changes and remember that overreacting to political shifts in the short term could lead to missed financial opportunities.

"Take a longer-term horizon – 10, 15, 20 years – and then, look at what presidents can do by themselves and what they need Congress to help them with," said McNab. "So, if a president gets inaugurated on January 20th and starts throwing a lot of policy out that will significantly raise prices or change labor policy, then, of course, you’re going to be worried. But if presidents are going to maintain the status quo, sort of keep things going on as they’ve been going on, then investors typically become much more conservative in their approach."

According to McNab, data from past election years suggests that markets tend to follow broader economic fundamentals, not just political agendas. And while election cycles may bring some short-term volatility, they rarely dictate long-term trends.

"The U.S. economy's outperforming every other industrialized nation on earth– lower inflation, more job growth, higher GDP growth, greater returns on stock prices. So, from a large-scale perspective, it's been a relatively good run," McNab said, citing a disconnect between economic data and consumer sentiment.

"What needs to be done, really, is to look at ways to help consumers navigate a tricky financial situation that their wages have increased, but they don’t feel like they’re getting ahead,” he said. “That also trickles into investment decisions because if people's perceptions are different from the data and they invest upon their feelings and perceptions, they could find themselves in a precarious financial situation."

McNab cautioned about making investment decisions based on election results, particularly ones motivated by party loyalty.

"A lot of people will wake up on Wednesday or Thursday, or whenever we know the election results, and make investment decisions based upon their political party," McNab said. "If you’re Republican and Vice President Harris is elected, you might think the economy is going south and sell everything that you have in the stock market. If you’re a Democrat and President Trump is elected, you might do exactly the same thing and sell everything in anticipation of a recession."

He noted, however, that markets tend to favor a Congress where one party doesn't control both chambers because abrupt policy changes that could disrupt the economy are less likely.

"Political gridlock kind of means that you end up in the same place that you were before," McNab said. "We don’t expect anything to get done, so things can kind of continue as they are. And right now, given the performance of the U.S. economy, the best thing for a president really to do is to do nothing – get out of the way, let the economy continue the work, don’t disturb what’s working reasonably well, and improving, and take credit for that rather than trying to make fundamental changes that could disrupt not only the economy but people's finances."

Nonetheless, selling or buying based on political fear can be financially damaging, McNab said, and possibly result in missed future gains or heavy penalties.

"If you have a significant amount of money or even a not significant amount of money, that is invested in financial markets that’s outside a tax-deferred investment vehicle like a[n] IRA or a 401(k), then if you go off and sell assets, you could be subject to significant capital gains taxes. And those will be due next year by mid-April, which is no fun to get an unexpected tax bill," McNab said. "A good way to break yourself from doing something silly is to really say, 'Hey, I’m thinking of doing this, I need to talk to a tax professional, make sure that I’m not exposing myself to taxes that I don’t expect."

While it's normal to feel nervous about political changes, McNab said building a well-diversified portfolio is one of the best defenses against market volatility, and any one event – including an election – will likely have a limited impact on its overall performance.

"Really, at the end of the day, it’s like any investment decision – try to take your heart out of it, try to take a longer-term perspective, and don’t panic," he said.

For people looking to shore up their finances amid election uncertainty, McNab advised following a straightforward financial strategy.

"Have an emergency fund... so you’re no longer lurching from crisis to crisis, but you are sort of having a cushion to fall back upon," he said. "Get out of buying things on credit cards, unless you can pay off the credit cards weekly. Treat your credit card like an ATM card rather than a loan that you’re surprised with at the end of every month."

He also suggested taking advantage of employer retirement contributions.

"If your employers are offering a retirement match, [they're] offering, essentially, free money," McNab said. "That’s 100% return for every dollar that you put in. And you shouldn’t turn that down."

Regardless of the specifics of one’s saving and investing strategy, he said that casting your vote should be a priority as it helps shape the economic policies that affect your finances.

"If you don’t vote, you’re not letting your voice be heard. And then, you can’t blame anybody else for what happens," McNab said. "Buying in financial markets is voting about the state of the economy. So, if you take time to invest, you might as well take time to go."