LEFT BEHIND: Struggles and Survival in the post-pandemic world

The COVID-19 pandemic impacted so many aspects of our lives, including our jobs and bank accounts. Now, there’s hope as Hampton Roads slowly returns to normal.

The countdown is on to the end of COVID-19 restrictions in the Commonwealth.

Governor Ralph Northam lifted the mask mandate on May 15 and on May 28, social distancing and capacity limits end in Virginia.

It sets the stage for a long-awaited return to normalcy this Memorial Day weekend and a potential economic boom for the Hampton Roads region.

To be exact, it’s been 442 days since the World Health Organization declared the coronavirus outbreak a pandemic.

It was enough time to wreak havoc on cities, businesses, and households everywhere. The result was the tale of two economies: the fortunate ones kept their jobs and saved money, while others faced unemployment and hunger.

It’s clear that not everyone is primed to take full advantage of the recovery. Instead, they’re left wondering if this is just another year they’ll be left behind.

Chapter 1 Food Insecurity Hits Hampton Roads

There is a hidden struggle inside homes across Hampton Roads that the pandemic only worsened. Food insecurity can affect people anywhere, but it has become a glaring issue in the Young Terrace neighborhood of Norfolk.

"In Norfolk, the food insecurity rate is about 14.5 percent. In this community, the food insecurity rate is 57 percent,” said Emma Inman, the Vice President of Programs and Development for the Foodbank of Southeastern Virginia and the Eastern Shore.

About three out of five people living in Young Terrace are food insecure, meaning they have “limited or uncertain access to adequate food,” as defined by the U.S. Department of Agriculture.

The Foodbank’s Emma Inman said the coronavirus pandemic exacerbated levels of food insecurity in predominantly minority communities like Young Terrace.

"Food insecurity existed in this community well before the pandemic, but you also had this situation where people had job losses, offices closed, restaurants closed, impacting folks' ability to bring home their regular income,” Inman said.

To make matters worse, Young Terrace became a food desert when the last remaining grocery store in the area closed its doors in the middle of the pandemic. And there’s no sign the now-vacant Save A Lot off Church Street will be replaced anytime soon.

The Foodbank saw the need and opened a food hub in Young Terrace, half a mile from the old Save A Lot. It's basically a mini-grocery store that's open once a week for a few hours where neighbors can grab enough free and healthy groceries to feed their family.

The Foodbank aims to distribute healthy food to hungry residents not just in Young Terrace, but across the entire region. Inman said food insecurity increased 20-percent across South Hampton Roads during the pandemic.

Every other month, the Foodbank provides food at a drive-thru food pantry at the Virginia Beach Amphitheater. They distributed food to more than 1,400 households in April, and they’ll do it again in a few weeks.

Despite the coronavirus becoming more manageable, Inman fears the pains of the pandemic will last far longer for many of our neighbors.

"Throughout the last year, we've had folks coming to mobile food pantries that we provide or other food services that we provide who have never before in their lives needed to reach out for charitable food assistance,” Inman said. "We're expecting to see those impacts for quite some time."

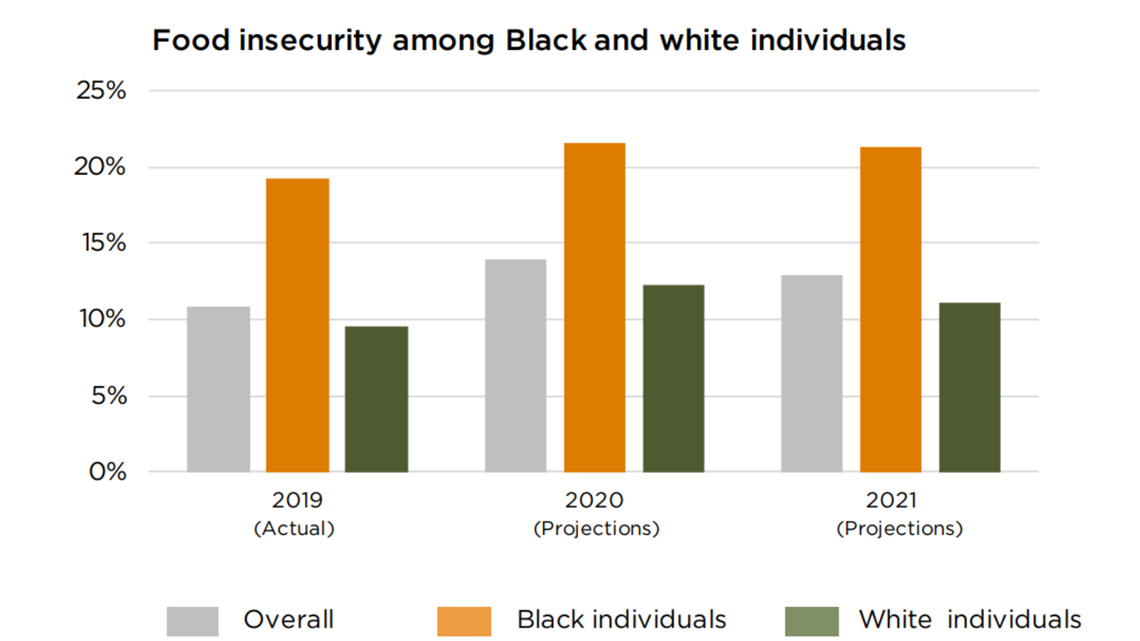

Feeding America analyzed the situation and concluded that while food insecurity will likely improve in 2021, racial disparities will remain in the wake of COVID-19.

Chapter 2 Job Loss and Racial Inequities

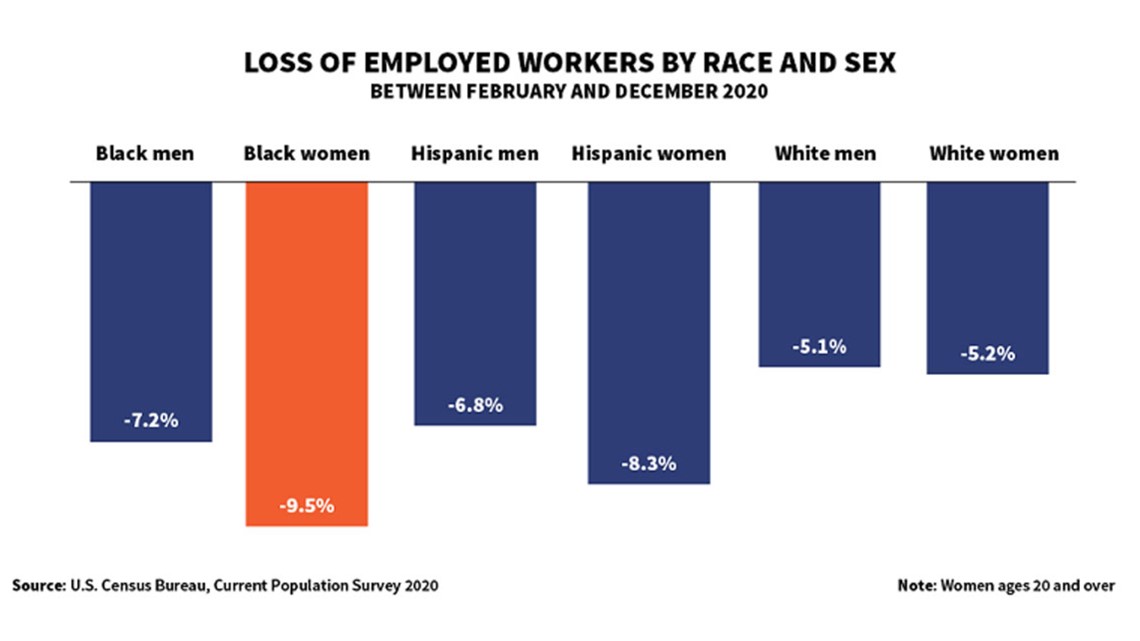

Food insecurity rises in tandem with unemployment, and Black Americans were also disproportionately affected by the economic impacts of the pandemic. Black women were twice as likely as white women to lose their job during the pandemic.

That disparity can be partially blamed on job losses in government and leisure and hospitality.

Data cited by the U.S. Department of Labor tells the story: 9.5 percent of Black female workers became unemployed between February and December 2020.

Tremaine Wills is the founder of Mind over Money in Newport News. She brands herself as a financial coach for Black Women and is concerned by the data.

"When we have things that impact the country as a whole, you start to see where the disparities are by who is able to capitalize and who gets left behind,” Wills said. "Not only are we not making as much as our peers, [but we also] don't have enough in savings, so our income streams are cut off, so now we're trying to figure out how are we going to survive?"

Wills says survival was made easier for those with emergency savings like Shakiya Gardner.

"Savings definitely helped during the pandemic,” Gardner said.

Gardner is a hairdresser by trade but an entrepreneur at heart. Her hair salon in Hampton remains open today thanks to her resiliency during the pandemic and her access to savings.

“If it wasn't for my savings, I probably would've been struggling because my expenses are extremely high between my salon, my businesses, and my home, my expenses are extremely high,” Gardner said.

When Gardner wasn't busy with the hair salon, she was building a new business online. She launched a website selling hair care products out of a warehouse in Suffolk. In fact, that business benefited from the stay-at-home economy and produced record profits in 2020.

“With my business growing as fast as it did, a lot of the things they don’t talk about, especially in the Black community and entrepreneurship, is the need of access to capital and funding. I generated seven figures but I also put a lot of money back into my business,” Gardner said.

But while some forge ahead, others are left behind. And history tells us playing catch-up won't be easy. After the Great Recession of 2008, it took a decade for Black women to recover from job losses. And most of those gains were wiped out by COVID-19.

Chief Economist Janelle Jones from the U.S. Department of Labor says the economic recovery is not complete if some communities are left behind.

“We saw this in the aftermath of the Great Recession; while headline numbers touted ‘recovery,’ many Black women -- and their families and communities -- continued to struggle,” Jones wrote in a February blog post.

The U.S. Department of Labor would not make Jones available for an interview with 13News Now. Instead, a spokeswoman directed us to her blog post that offered possible solutions to an inclusive recovery, including new policies and targeted relief.

Wills agreed but said re-building an inclusive economy is no guarantee.

“The conversation has to be real, and it all comes back to equity,” Wills said. “If I’m in a position of power and I hold more equity, I have to be willing to give up some of that equity. And until we’re ready to make that shift, we can have all the conversations in the world, nothing will change.”

Chapter 3 Drafting a Financial Plan

The pandemic disrupted even the best-laid plans. So, what money moves can you make now to ensure you’re not left behind?

We asked Bobbi Rebell, a certified financial planner and personal finance expert at Tally, for advice.

Q: What advice do you have for someone who wants to be financially responsible but has no idea where to start. What’s the first thing they should do?

- The first thing they should do is think about the reason that sparked this sudden focus.

- That will motivate you because it’s your pain point.

- For example: did they suddenly realize how much debt they are carrying? Get a debt plan in place; an app like Tally is a great resource.

- Or did their low credit score keep them from getting something they wanted? If that’s the case, then that’s where they should focus their efforts.

- Is it the desire to buy something they don’t have the money for? Then they should start budgeting and saving.

- Is it FOMO about investing because of all the buzz they are hearing about? Then they should start looking at what resources they have to get started in investing and what they should have in place before they do, such as an emergency fund and getting debt under control.

Q: What about for someone who had to cut back on their savings in 2020. What should be their new priorities if they’re reading to catch up?

- The first priority is to rebuild your savings to a level that you feel would cover you should we have another pandemic. We don’t want to believe it could happen again, but we never believed it could happen in the first place.

- The best strategy is to use automation and tools to help you put money away regularly. As for how much, this really depends on how much you can afford to save each month and how much you have saved. If you have any high-interest debt, you should work on paying that down simultaneously.

Q: Is it better to have cash in a savings account for emergencies or put it away in a retirement account?

- First and foremost, you need cash and other liquid assets like money market funds and short-term CD’s that you can easily access in an emergency. I recommend having at least 3-6 months’ worth of expenses. Retirement can come next.

Q: What’s the best strategy for someone who’s ready to pay off the debt they had to take on last year?

- Different rules for different debt.

- If you have high-interest debt (read: credit card debt), making extra payments on your principal debt will definitely help lower how much you pay in interest. Also, consider using tools like the Tally app to pay down your credit card debt faster, and potentially consolidate it into a lower interest loan.

- But if your debt is a fixed amount at a low rate (mortgage or car payment), it may be more advantageous to put any extra money towards bolstering your emergency savings even more.

Chapter 4 Hampton Roads Leaders Aim to Get Ahead

Hampton Roads was slow to rebuild jobs after the Great Recession, compared to other regions and cities.

And some local leaders fear history could repeat itself if they don’t approach this downturn differently.

"One of the things we've always been criticized for in Hampton Roads is that lack of collaboration,” said Hampton Roads Chamber of Commerce President Bryan Stephens. "757 is one region and we all need to come together."

Stephens' job is to sell Hampton Roads. As Chamber of Commerce president, he's optimistic about the region's future but he's not naive to the hurdles.

"We're in a competition for talent,” he said. “Our competition is Charlotte, our competition is Northern Virginia, and when you're in a competition, you've got to get aggressive."

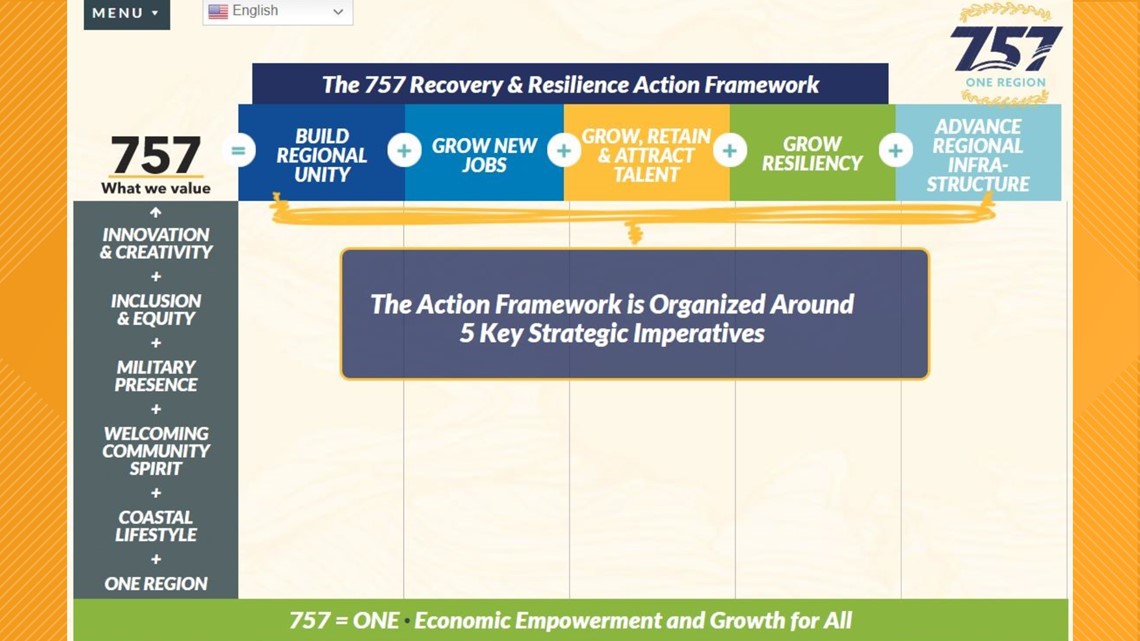

Hampton Roads regional leaders like Stephens designed the "757 Recovery and Resilience Action Framework." It's essentially a playbook they’re rolling out right now to come back stronger than ever before.

The 757 Framework is broken down into five strategic focus areas:

- Build Regional Unity

- Grow New Jobs

- Grow, Retain and Attract Talent

- Build Resiliency

- Advance Regional Infrastructure

Doug Smith, President of the Hampton Roads Alliance, helped draft the recovery plan and provides periodic video updates on the Framework.

“The narrative that Hampton Roads doesn’t collaborate is an old narrative, frankly it’s just not true,” Smith said in a YouTube video touting the 757 Framework. “It’s clear that if we’re going to recover and recover quickly and be more resilient, then we’re going to have to do that together.”

ODU Economics Professor Dr. Robert McNab said the cities have tried before to come together but unsuccessfully.

“We have to get over this hump that if one city wins, another city loses,” Dr. McNab said. "The question is not the vision of 757 recovery and innovation. There are great possibilities. It's whether we can get out of our own way to do it."

Dr. McNab wonders if the painful memories from the last recession will affect change this time around. He cited sobering statistics in the 2020 State of the Region report showing Hampton Roads was left behind during last decade’s expansion:

- After the Great Recession, the United States and Virginia recovered all lost jobs in about 70 months. It took Hampton Roads more than 100 months.

- On a proportional basis, for every new job added in Hampton Roads last decade, the United States added two.

- In terms of money, for every $1 of new output created in Hampton Roads, Virginia created nearly $3, while the rest of the nation created more like $5.

Dr. McNab blamed last decade’s slow recovery in part on the region’s unique dependence on the federal government.

"Defense spending accounts for approximately 4 out of every 10 dollars in the Hampton Roads economy,” Dr. McNab said. "Now you're saying, 'OK, we want to generate more growth.' You don't control 4 dollars out of 10, so you have to generate the growth elsewhere."

The Hampton Roads economic pie is divided into three big pieces: military, trade, and tourism. The pandemic took a big bite out of tourism and growing a more profitable pie for the future requires adding more private-sector jobs.

The Chamber has the same goal but getting there means selling the region as one 757.

"When you look at really successful regions and those regions that really recovered rapidly from the recession and are doing well to this day, they all come together for the greater good of the region,” Stephens said.

Hampton Roads Alliance invites anyone living in the region to do their part in rebuilding a better region by registering to become a 757 Champion. Participants will serve as regional advocates and receive occasional progress reports by email as leaders work to get the local economy back on track.

Chapter 5 Returning to Normal

Getting our economy back on track won’t happen overnight. But with so many things about to reopen, it should get a boost this summer.

Big events like concerts are coming back and bringing big bucks with them. The Veterans United Home Loans Amphitheater in Virginia Beach already has a few concerts on its schedule.

But smaller venues are also drawing in musicians, comedians, and monster truck shows to get cash flowing in Hampton Roads.

“We’re hoping we will be able to restore probably at least 80 percent of the acts we had to cancel,” said Hampton Roads Artistic Director Richard Parison. “Tickets are on sale for the Eric Church concert, which will be in February 2022. Space Camp the EDM show in December already sold out, two shows.”

Sports will also help bring our economy back to life, and it’s already happening in Norfolk. On Friday, Harbor Park will open at full capacity as the Norfolk Tides continue their first homestand of the 2021 season. Norfolk’s other professional team, the Admirals, plan to play a full hockey season starting in October.

And some big festivals are returning to Hampton Roads this summer. The Virginia International Tattoo starts in a week. It’s usually held at Scope Arena but is moving outdoors to ODU’s S.B. Ballard Stadium this year.

No doubt, the pandemic took a huge toll on our economy, and more importantly, on the people who keep it running.

But there’s hope on the horizon. History shows it won’t happen overnight, but we will get back on track.