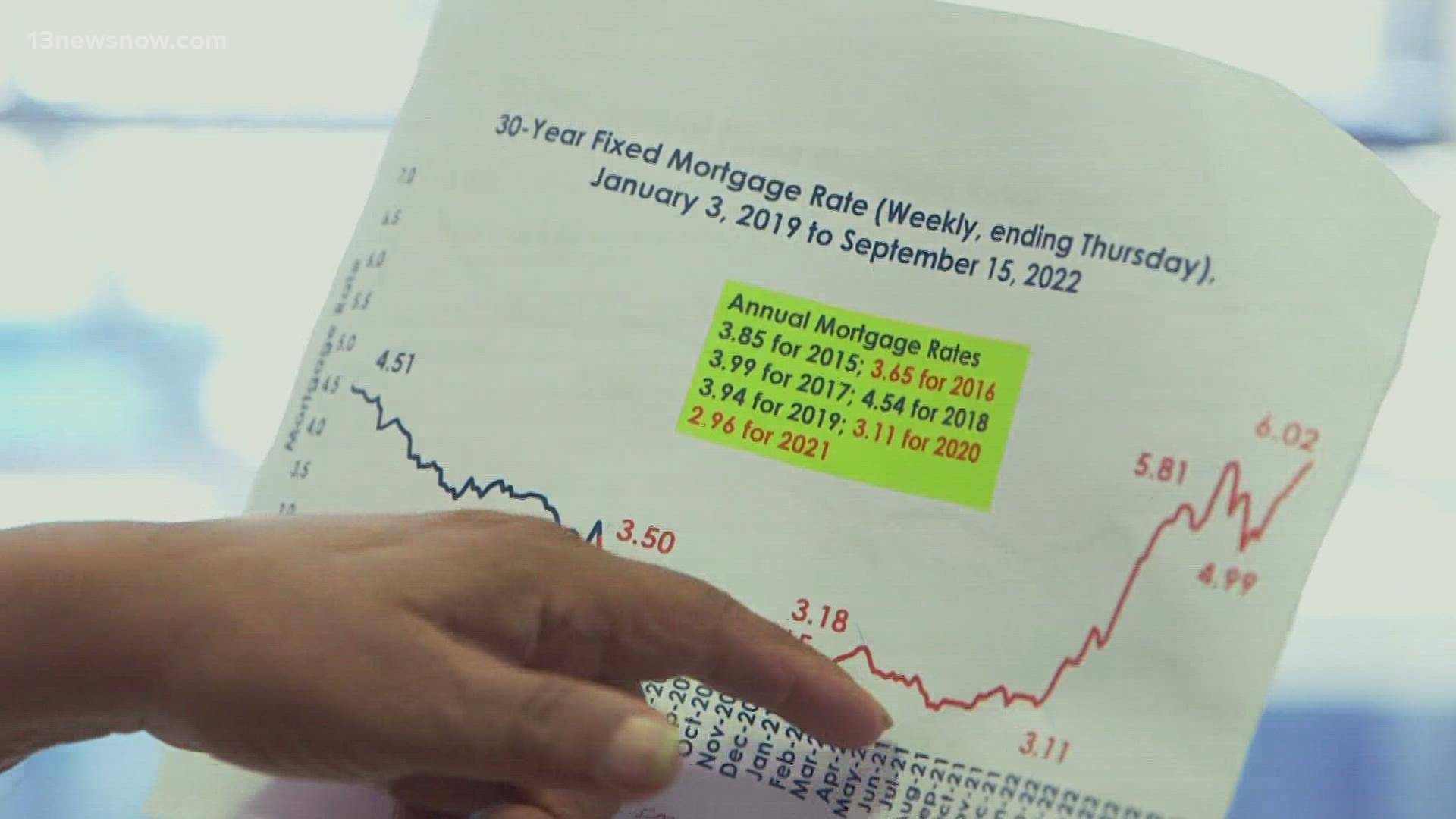

NORFOLK, Va. — What a difference a year makes. Mortgage rates have now topped 6%, which is more than double what homebuyers saw around the same time in 2021.

ODU Economics Professor Dr. Vinod Agarwal said 2021 had the lowest mortgage rates in the history of the United States.

The last time rates were this high was during one of the worst economic periods in recent U.S. history. In 2008, mortgage rates climbed above 6%, a symptom of a housing bubble that crashed the U.S. economy.

But if you were to go back to the 1980s, 6% would have been a welcome site.

Rates were astronomical in the 1980s, reaching as high as 16.63% in 1981.

But inflation was stable back then, and home prices were low, so it’s not a great comparison.

There is, however, a comparison people are making about our current situation.

“I’ve been asked this question several times: Do we see a repeat of what we saw in 2008, 2009, and 2010?” said Agarwal.

Fortunately, Agarwal says the answer is no. That’s because lending practices were a lot different leading up to the burst of the housing bubble in 2008.

Agarwal is also seeing a more steady drop in the volume of home sales, meaning a shift away from a sellers’ market, a result of the Federal Reserve’s aggressive interest rate hikes.

While it’s a good sign for inflation, and mortgage rates, Agarwal expects the latter to get worse before it gets better.

His prediction is that mortgage rates will peak at around 6.25 percent sometime soon. But his timeline for a rebound is sooner than you may think.

“I will still say by the time the year is out,” said Agarwal. “We expect annual mortgage rates to be around 5%, not 6%.”